In ever-evolving landscape of financial transactions, businesses often find themselves grappling with the challenges posed by chargebacks and retrieval requests.

As essential components of the payment ecosystem, understanding the difference between these two processes becomes essential for merchants seeking effective dispute resolution.

We have discussed the fundamental aspects of retrieval requests and chargebacks, along with the distinct stages, financial implications, and response requirements associated with each.

From exploring the initiation and purpose to comprehending the intricate differences between these transactions, we navigate through the intricacies that merchants encounter in their day-to-day operations.

What is a Retrieval Request?

A retrieval request is a formal inquiry initiated by a cardholder's issuing bank to obtain more information about a specific transaction. It is not a chargeback but rather a precursor to one, serving as a means for the bank to gather details regarding a particular purchase.

In simpler terms, when a customer reviews their credit or debit card statement and encounters a transaction they don't recognize or have questions about, they can contact their bank. The bank, in turn, sends a retrieval request to the merchant for additional information.

This request typically seeks clarification on the details of the transaction, such as the date, amount, and description of the purchase. Merchants are then obligated to promptly respond to the retrieval request by providing the requested information and assisting the cardholder and the issuing bank in resolving any uncertainties.

The purpose of a retrieval request is to ensure transparency and understanding between the customer, the merchant, and the issuing bank before any further actions, like a chargeback, are considered. It's an opportunity for merchants to address concerns and prevent potential disputes.

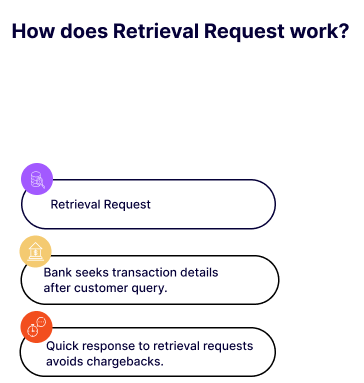

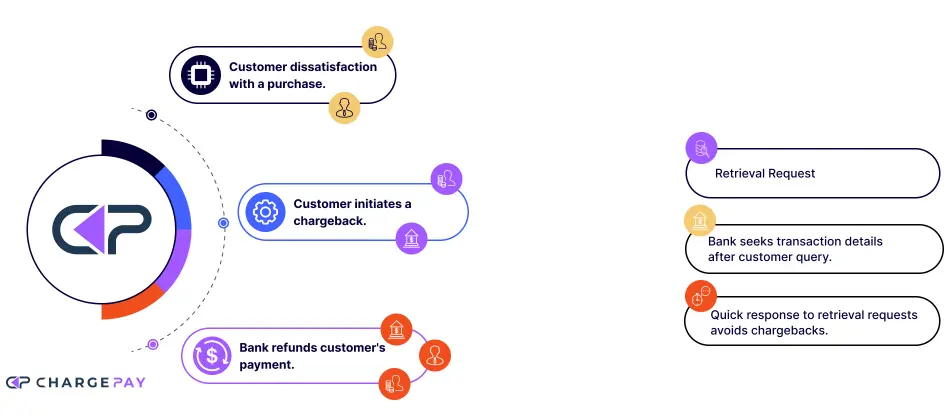

1. How does Retrieval Request work?

A retrieval request operates as a straightforward process designed to gather essential information and resolve uncertainties surrounding a particular transaction. Here's a simplified breakdown of how it works:

1. Cardholder Identifies a Transaction Issue

The process begins when a cardholder notices a transaction on their credit or debit card statement that appears unfamiliar or raises questions.

2. Cardholder Contacts Issuing Bank

Seeking clarification, the cardholder contacts their issuing bank to express concerns about the transaction.

3. The Issuing Bank Initiates a Retrieval Request

In response to the cardholder's inquiry, the issuing bank initiates a retrieval request, formally reaching out to the merchant for additional details on the specific transaction.

Merchant Receives the Retrieval Request

Upon receiving the retrieval request, the merchant must promptly acknowledge it and provide the requested information, including transaction details and any supporting documentation.

4. Issuing Bank Reviews Information

The issuing bank reviews the information provided by the merchant, using it to address the cardholder's concerns and determine the transaction's legitimacy.

5. Resolution or Escalation

Based on the information gathered, the issuing bank may resolve the matter with the cardholder, or if issues persist, they may escalate the case to a chargeback.

Merchants must understand that a retrieval request is not a chargeback but rather an inquiry seeking clarification. Timely and accurate responses to these requests can often prevent the escalation to a chargeback, preserving the merchant-customer relationship and minimizing potential financial repercussions.

What is a Chargeback?

A chargeback is a formal dispute initiated by a cardholder with their issuing bank, requesting a refund for a specific transaction. Unlike a retrieval request, a chargeback represents a more advanced stage in the resolution process and carries financial consequences for the merchant.

It's essential for merchants to actively manage chargebacks by addressing customer concerns, maintaining clear transaction records, and implementing fraud prevention measures. While chargebacks are a tool to protect consumers, they also highlight potential issues in the merchant-customer relationship that need attention.

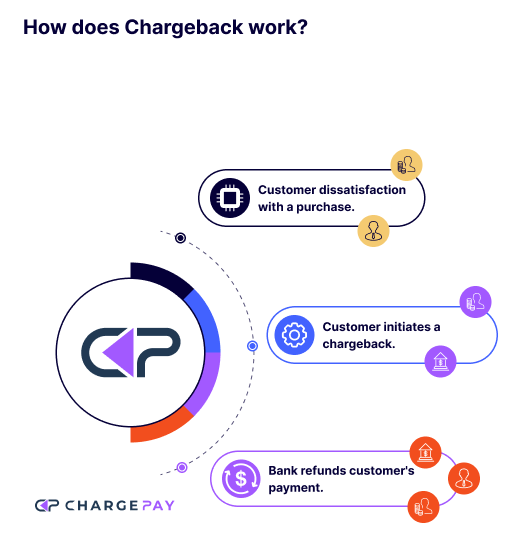

How does Chargeback work?

Understanding the mechanics of a chargeback is crucial for merchants to navigate the dispute resolution process effectively. Here's a straightforward overview of how a chargeback works:

1. Cardholder Initiates Dispute

The process begins when a cardholder, dissatisfied with a transaction, contacts their issuing bank to dispute the charge. This can be due to various reasons, including unauthorized use, fraud, or dissatisfaction with the received goods or services.

2. Issuing Bank Launches Chargeback

Upon receiving the cardholder's dispute, the issuing bank initiates a chargeback by debiting the transaction amount from the merchant's account. The merchant is notified of the dispute and the impending chargeback.

3. Reason Codes Assign Dispute Category

Chargebacks are categorized using reason codes, indicating the specific grounds for the dispute. Common reason codes include fraud, non-receipt of goods, defective products, or billing errors.

4. Merchant Receives Chargeback Notification

The merchant is notified of the chargeback and provided with details, including the reason code and the amount in dispute. The merchant needs to act promptly upon receiving this notification.

5. Merchant Responds with Evidence

To dispute the chargeback, the merchant must provide compelling evidence to demonstrate the legitimacy of the transaction. This evidence may include order confirmations, delivery receipts, or communication records.

6. Adjudication by Payment Processor

The issuing bank reviews the evidence submitted by both the cardholder and the merchant. The payment processor acts as an intermediary, adjudicating the dispute based on the presented information.

7. Resolution and Financial Implications

Depending on the outcome, the chargeback may be either upheld or rejected. If upheld, the funds are reversed from the merchant's account to the cardholder, along with potential chargeback fees. A rejected chargeback means the funds remain with the merchant.

Merchants should be proactive in addressing customer concerns, providing evidence, and implementing preventive measures to minimize the occurrence of chargebacks.

Differences Between Retrieval Requests and Chargebacks

Understanding the distinctions between retrieval requests and chargebacks is essential for merchants to navigate the complexities of transaction disputes. Here's a straightforward breakdown of the key differences:

1. Initiation and Purpose

Initiated by the issuing bank, a retrieval request aims to gather additional information about a specific transaction. It acts as a preliminary step before a potential chargeback, focusing on clarifying transaction details and ensuring transparency.

Initiated by the cardholder through their issuing bank, a chargeback is a formal dispute seeking a refund for a contested transaction. It represents a more advanced stage in the resolution process, carrying financial consequences for the merchant.

2. Stage in the Dispute Resolution Process

Retrieval requests occur at an early stage when a cardholder has questions about a transaction but has not yet formally disputed it. It serves as an initial inquiry seeking clarification.

Chargebacks represent an advanced stage where the cardholder has formally contested the transaction. This can lead to a potential reversal of funds from the merchant to the cardholder.

3. Financial Implications

Generally, retrieval requests do not result in an immediate financial impact on the merchant. They are part of the information-gathering process to prevent misunderstandings.

Chargebacks involve the reversal of funds from the merchant to the cardholder, along with the possibility of additional chargeback fees. This results in a direct financial impact on the merchant.

4. Communication Purpose

Retrieval requests primarily seek additional information and clarification from the merchant to address cardholder concerns. The focus is on providing transparency.

Chargebacks signal a formal dispute and dissatisfaction with the transaction. The primary aim is to secure a refund, making it a more serious stage in the resolution process.

5. Resolution Opportunities

Retrieval requests provide an opportunity for merchants to address customer concerns, prevent misunderstandings, and proactively avoid chargebacks by offering clarification.

Chargebacks represent a more advanced stage with a narrower window for resolution. The financial impact on the merchant is more immediate, making it crucial to manage disputes effectively.

6. Response Requirements

Merchants must respond promptly to retrieval requests, providing the requested transaction details to address the cardholder's concerns and prevent escalation.

Responding to chargebacks requires merchants to present compelling evidence to dispute the cardholder's claim. This is crucial in influencing the resolution decision.

7. Preventive Measures

Retrieval requests offer merchants a proactive step to prevent potential chargebacks by providing transparent transaction details, and addressing concerns before they escalate.

Chargebacks highlight the need for merchants to implement effective preventive measures, such as fraud prevention, to minimize the occurrence of formal disputes and protect their reputation.

Chargeback and Retrieval Fee

A chargeback fee is a financial penalty imposed on merchants when a chargeback occurs. This fee is intended to cover the administrative costs associated with processing the dispute. Merchants may face a chargeback fee regardless of the outcome of the dispute, making it important for businesses to actively manage and prevent chargebacks.

On the other hand, a retrieval fee is associated with retrieval requests rather than chargebacks. Merchants may incur a retrieval fee when the issuing bank initiates a retrieval request to gather additional information about a transaction. This fee covers the administrative expenses related to providing the requested information.

Key Differences

The chargeback fee is levied in response to a formal dispute initiated by a cardholder, reflecting the costs of processing the dispute. The retrieval fee is tied to the information-gathering process initiated by the issuing bank through a retrieval request.

Chargeback fees are typically charged after the resolution of the dispute, irrespective of whether the chargeback is upheld or rejected. Retrieval fees are incurred during the retrieval request process when the issuing bank seeks additional information from the merchant.

Chargeback fees can vary and are often higher than retrieval fees, reflecting the more advanced stage and financial implications of a chargeback. Retrieval fees are generally lower, representing the cost of obtaining and providing transaction details.

Debit or Credit Card Chargeback vs Retrieval

In the realm of debit card transactions, a chargeback involves the reversal of funds from a debit cardholder's account due to a disputed transaction.

This occurs when the cardholder formally contests a charge, prompting the issuing bank to investigate and potentially refund the amount.

On the other hand, a retrieval in the context of a debit card is an initial step that precedes a chargeback. It is a request for additional information initiated by the issuing bank to clarify transaction details before a formal dispute is made.

1. Timing and Stage

Debit card chargebacks take place after the cardholder has officially disputed a transaction, leading to the potential reversal of funds. This represents a later stage in the resolution process.

In contrast, retrievals occur at an earlier stage, initiated when a cardholder raises questions about a transaction but has not yet initiated a formal dispute. Retrievals serve as an initial inquiry seeking transaction details.

2. Financial Impact

A debit card chargeback results in the reversal of funds from the merchant's account to the cardholder, potentially impacting the merchant financially. This process involves chargeback fees and may harm the merchant's reputation. Conversely, retrievals generally do not result in an immediate financial impact on the merchant, although they may incur a retrieval fee for providing requested information.

3. Cardholder's Action

In a debit card chargeback, the cardholder actively disputes the transaction, citing reasons such as unauthorized use, fraud, or dissatisfaction. This initiates the chargeback process through the issuing bank.

In a retrieval, the cardholder raises questions or seeks clarification about a transaction, prompting the issuing bank to initiate the retrieval request to gather information from the merchant.

4. Response Requirements

Merchants responding to debit card chargebacks must act promptly, providing compelling evidence to dispute the cardholder's claim. Failure to respond may result in the chargeback being upheld.

For retrievals, merchants must respond to retrieval requests with accurate transaction details, addressing cardholder concerns and preventing potential escalations to chargebacks.

5. Prevention Strategies

To prevent debit card chargebacks, merchants can implement fraud prevention measures, maintain clear transaction records, and promptly address customer concerns.

Efficiently handling retrieval requests is crucial for prevention, where providing transparent information helps avoid misunderstandings and potential escalations to chargebacks.

6. Card Network Policies

Both debit card chargebacks and retrievals are guided by card network policies. The outcome of a chargeback depends on the evidence presented by both the cardholder and the merchant.

Retrieval requests are part of the card network's efforts to ensure transparency and understanding before formal disputes, underscoring the importance of accurate and timely responses.

Understanding these distinctions is crucial for merchants to navigate debit card transaction disputes effectively and minimize their impact on business operations.

Manage & Recovery Chargebacks with ChargePay

ChargePay revolutionizes chargeback management with its state-of-the-art AI-powered solutions, offering businesses a seamless and automated approach to contest and win chargebacks.

Employing cutting-edge technology, ChargePay ensures real-time responses to emerging disputes, significantly boosting the win rate and allowing businesses to reclaim up to 80% of previously lost revenue.

Beyond defense, ChargePay's AI system excels in identifying and countering chargeback fraud, providing a proactive layer of security.

With industry-agnostic solutions catering to eCommerce, entertainment, healthcare, and more, ChargePay integrates seamlessly with major payment processors, including PayPal, Shopify, and Stripe. Thus, making it a versatile and invaluable tool for businesses looking to streamline chargeback management and enhance overall financial performance.

.webp)

.svg)

.svg)

.svg)

.svg)